Finance Options

Whether it's that designer sofa you have always wanted, the luxury mattress for a perfect night’s sleep or even a new dining table for entertaining, we can help you to make it a reality with our choice of finance options.

We offer both Interest Free and Interest Bearing Finance options online and in-store at Downtown Stores.

Both our Interest Free and Interest Bearing Finance types require a deposit, and are available on purchases of selected products priced £500 or more. A minimum loan amount of £500 is required

Interest Free payments can be spread for up to 36 months, depending on your loan amount, and Interest Bearing payments can be spread for up to 60 months.

Interest Free Finance

-

Requires a minimum of 20% deposit.

-

For a spend of £500-£999 - spread your payments over 12 months

-

For a spend of £1000-£2499 - spread your payments over 12 or 24 months

-

For a spend of £2500 - spread your payments over 12, 24 or 36 months.

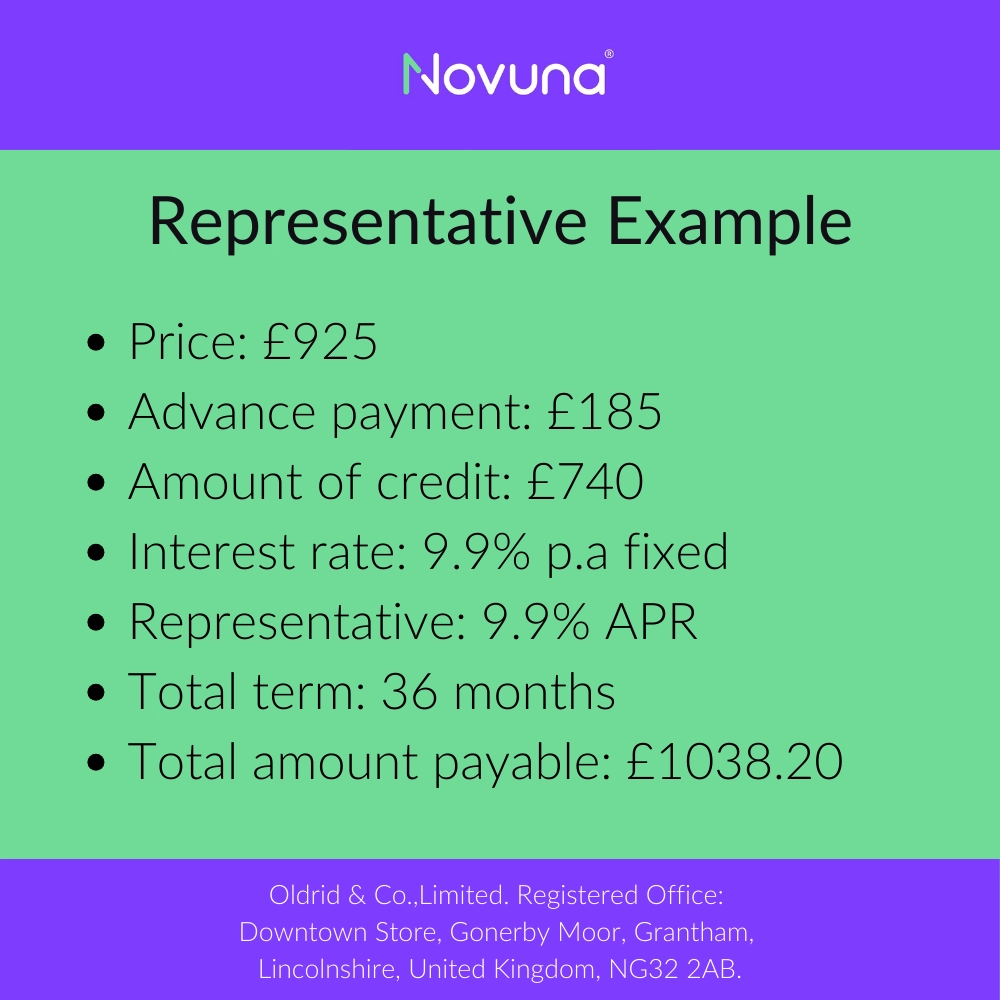

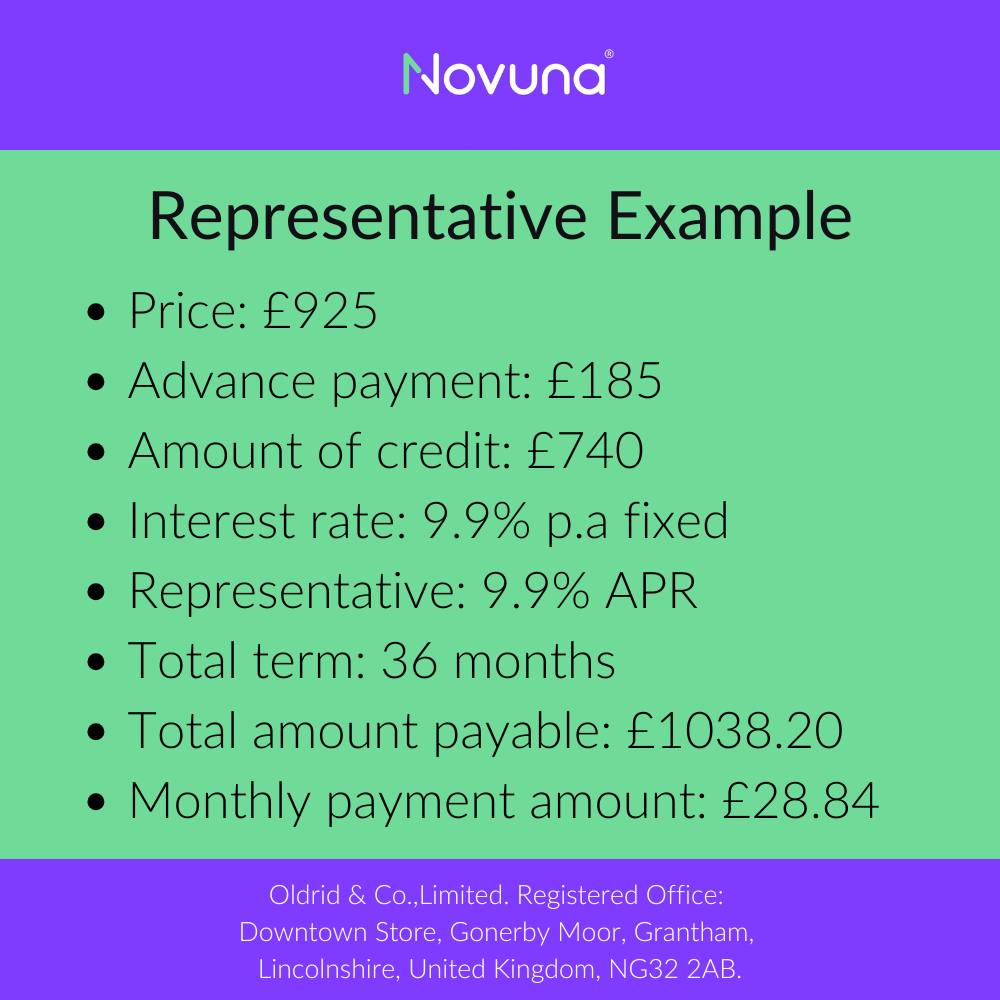

Interest Bearing Finance

-

Requires a minimum of 10% deposit.

-

The interest rate is 9.9% APR.

- Payments can be spread over 12, 24, 36, 48 or 60 months.

Online Finance FAQs

Who is eligible to apply for online finance?

To apply for finance, you must meet the following criteria:

- You must be over the age of 18

- You must work at least 16 hours per week, or be retired with an income

- You must be a resident of the UK and have lived in the UK for at least the last three years or more

- Applications are subject to status and your individual circumstances.

Homemakers aren't excluded from applying under their own names however, we will require the employment details of your spouse in order to process your application.

Which products are eligible for finance?

Products over £500 (excluding delivery) in the following categories are available to be purchased with finance online.

- Furniture

- Garden Furniture

- Sofas & Chairs

- Beds & Mattresses

Please note, if your basket contains products from a category that is not eligible for finance (e.g. your basket contains a sofa and a cushion) then you will not be able proceed with your finance order.

Do I need to pay a deposit?

Yes - a minimum of a 10% deposit is required for interest-bearing credit or 20% for interest-free credit.

You have the option to increase the deposit amount if you wish.

How long is the repayment period?

The minimum repayment period for Interest Free Credit (0.0% APR Representative) is 12 months, with a maximum of 36 months.

The minimum repayment period for Interest Bearing Credit (9.9% APR Representative) is 12 months, with a maximum of 60 months.

What is the minimum amount I can have on Finance?

Both our Interest Free and Interest Bearing Credit options are available on orders of £500 or more. A minimum loan amount of £500 is required and the maximum loan amount is £25,000.

When do I have to start paying?

Your monthly installment plan begins one month after your goods have been delivered.

Who provides the finance?

Our finance online and in-store is supplied by Novuna Personal Finance. Novuna Personal Finance is a trading name of Mitsubishi HC Capital UK PLC. Oldrid & Co.,Limited trading as Downtown acts as a credit broker and not a lender, credit is subject to status and affordability, and is provided by Mitsubishi HC Capital UK PLC who acts as the lender. Terms & Conditions apply. See in-store for details.

Oldrid & Co.,Limited trading as Downtown FRN 739473 are authorised and regulated by the Financial Conduct Authority.

How do I apply?

On our website, once you have added an applicable item to your basket and proceed to checkout, you will be presented with the option to pay by finance. This will present you with a finance calculator where you can select your finance terms. You will then be directed to follow the checkout process where you will be prompted to pay your deposit and then directed to Novuna Finance's finance application stage.

Once your application has been submitted with Novuna you will be directed back to our site and the next steps will be determined by the outcome of your application.

Can I still return a finance order?

Your rights to refund a finance order are not effected. For more information on our refund policy, please click here.

Can I cancel my credit agreement if I change my mind?

You have the right under section 66A of the Consumer Credit Act 1974 to withdraw from the agreement without giving any reason before the end of 14 days (beginning with the day after the day on which the agreement is made or, if later, the date on which we will tell you that we have signed the agreement).

If you wish to withdraw you must give the finance company notice in writing or by telephone or email. The name of your finance company will be clearly shown on your credit agreement (see contact details below). Please note that if you do give notice of withdrawal, you must repay the full amount of the credit without delay and in any event by no later than 30 days after giving notice of withdrawal.

How do I ask a question about the credit agreement?

If you have a question, require further information or if there is anything you do not understand regarding the credit agreement, please call Novuna Finance on 0344 375 5500 or seek free, independent advice from organisations such as the Citizen Advice Bureau or the Money Advice Service. Please note Downtown cannot access the personal details relating to your agreement.

How does finance work?

Both our Interest Free and Interest Bearing Finance types require a minimum of 10% deposit, and are available on purchases of £500 or more.

Interest Free payments can be spread for up to 36 months and Interest Bearing payments can be spread for up to 60 months.

Option 1 - Interest Free Credit

- For a spend of £500-£999 - spead your payments over 12 months

- For a spend of £1000- £2499 - spread your payments over either 12 or 24 months

- For a spend of £2500 - spread your payments over 12, 24 or 36 months.

Option 2 - Interest Bearing Credit

- The interest rate is 9.9% APR Representative

- Payments can be spread over 12, 24, 36, 48 or 60 months.